Let’s be honest—sometimes money is a touchy subject, especially for women. If you were raised in a similar environment to me, then you might have grown up believing that speaking about money was rude, greedy or selfish.

But here’s the thing: dreaming big about your future and planning for financial freedom isn’t just okay—it’s necessary.

As women, we have to think about our financial security. Statistically, women earn less on average than men, and we tend to live longer, which means we need more savings to cover retirement. On top of that, many of us step into caregiving roles—whether for kids, aging parents, or both—that can pause or derail our careers.

Financial security is about the freedom to make choices for your life. It’s about being able to leave a toxic situation if necessary, start your dream business, or sleep better at night knowing you’ve got a safety net. It’s about having the power to call the shots on your terms.

That’s why in this episode of The Rachel Hollis Podcast, we’re tackling this head-on. I’m answering your biggest questions about money– from how to dream unapologetically big to setting goals that align with your values and releasing the guilt society loves to hand us about financial freedom. If you’ve ever felt hesitant about pursuing financial freedom or setting bold money goals, this one’s for you.

But before you dive into the episode, let’s unpack some of the major themes and set the stage for why this conversation is so critical.

Why Do We Feel Guilty About Money?

Where does this money guilt comes from? For many of us, our earliest beliefs about money were shaped by what we heard growing up. Maybe it was a parent who said, “Money doesn’t grow on trees,” or teachers who emphasized hard work over financial literacy. These messages often planted the idea that wanting more money was somehow wrong or frivolous.

On top of that, there’s the societal double standard. Men are often encouraged to chase wealth and success without apology, while women are expected to focus on nurturing roles or “staying humble.” We carry these unspoken rules with us into adulthood, and they hold us back from dreaming as boldly as we deserve.

Here’s the truth: money isn’t the villain. It’s just a tool—a resource that, when used wisely, can create freedom, opportunity, and allow you to take care of the people you love most.

Set Financial Goals That Align With Your Values

Big dreams are one thing; taking action is another. This is where a little clarity goes a long way. Start by asking yourself: What does financial freedom look like to me?

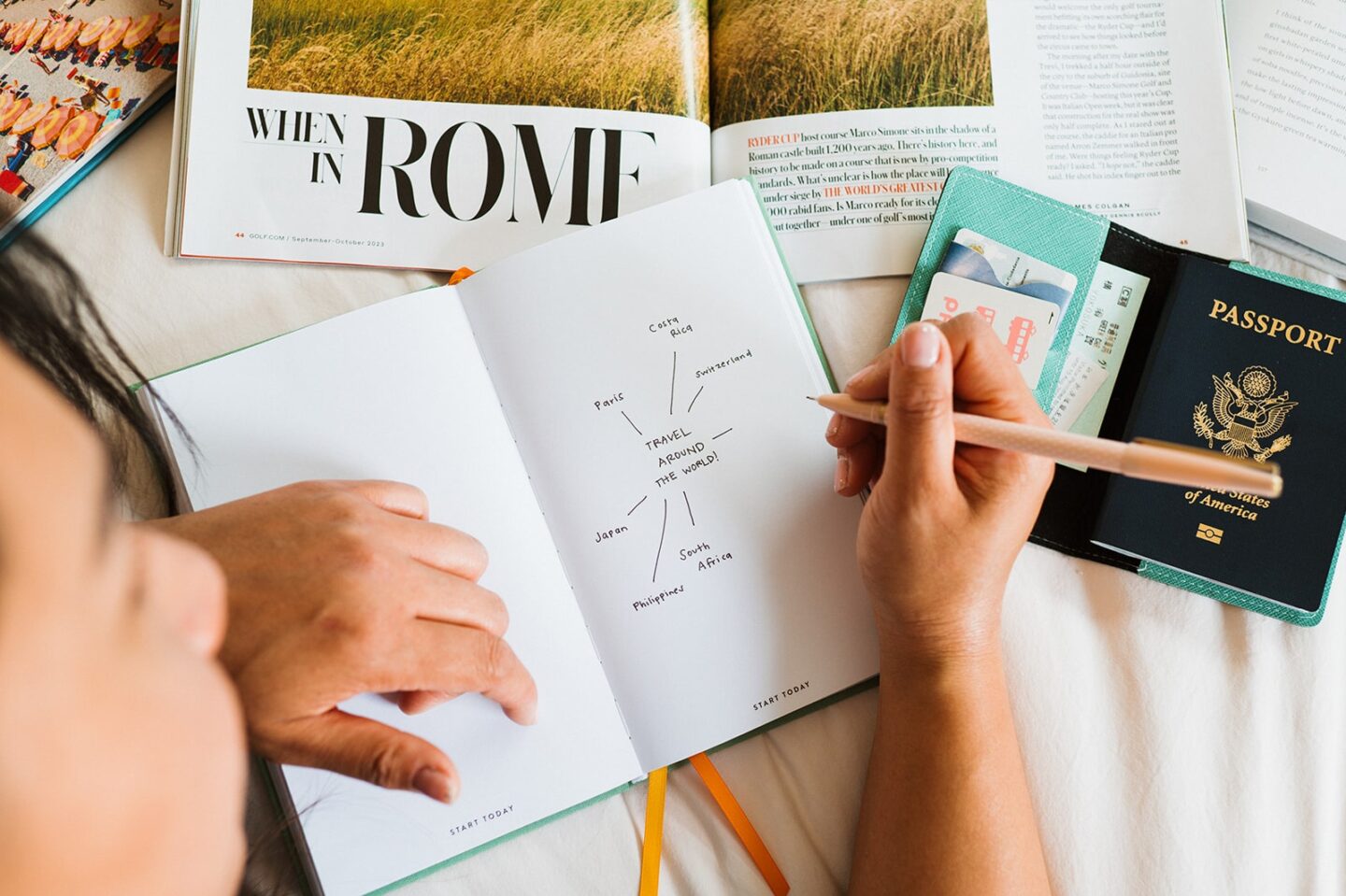

For some, it might mean paying off debt or saving for a dream home. For others, it’s the flexibility to travel the world or leave a nine-to-five job. Whatever it is, write it down and get specific. The clearer your goals, the easier it is to create a plan to achieve them.

And here’s the big one: let go of the guilt. If your financial dreams are rooted in your values, there’s nothing selfish about pursuing them. Surround yourself with examples of people—especially women—who’ve dreamed big and achieved their goals. Their stories are proof that it’s possible.

Talk About Money

If there’s one thing I hope you take away from this conversation, it’s this: we need to start talking about money. Openly, honestly, and without shame. The more we normalize these conversations within our trusted circles, the more we empower ourselves and each other to break free from the stigma.

When you share your financial goals with people you trust, you’re not just inviting accountability—you’re also creating space for others to dream big, too. Imagine the ripple effect if more women felt confident and unapologetic about their financial ambitions.